By Falco

12 May 2025

• White smoke in Rome, but fog in the global economy.

• Macro data reinforces Fed hesitancy in cutting policy rates.

• Tariff news flows but still a lack of concrete agreements.

• Japanese equities back on the front foot?

• Are India-Pakistan tensions a reflection of the times?

Last week was an eventful one for the current global order, but at a time when the world appears as a sharply divided entity, white smoke signalled joyfully the arrival of a new leader for 1.4 billion Roman Catholics, a moment that signified clarity and unity for a global faith. Unfortunately, beyond the walls of the Vatican, the world remains lost in a dense fog of multipolar political confusion, where no single power leads, alliances shift unpredictably, and consensus on global challenges is elusive. The contrast is stark.

Meanwhile, investors continue to wade through a complex mix of long-term macroeconomic concerns, trade tensions, a hesitant Federal Reserve, and increasingly volatile geopolitics. While equity markets have remained broadly resilient despite those concerns, cracks are beginning to show as structural weaknesses in the US economy resurface, and global fault lines threaten to redraw the investment map.

US Macro Data Highlights Structural Strains

The latest US productivity and wage data painted a not-so-impressive picture. Nonfarm business sector productivity fell 0.8% in the first quarter—its sharpest decline since early 2022. Compounding the issue, unit labour costs surged 5.7%, well above consensus expectations of 5.1%. This combination of weak productivity and strong wage growth is troubling and suggests that inflationary pressures are being sustained by cost-push dynamics, not by healthy economic expansion.

Against this backdrop, President Trump’s renewed push for his 2025/26 budget has intensified market unease. The proposals include a fresh round of tax cuts, which, while potentially stimulative in the short term, appear unfunded by equivalent spending reductions. With US deficits already running at levels not typically seen outside of wartime or recessionary periods, the risk is that bond investors may begin to demand a higher term premium to compensate for growing fiscal imbalance. Long-term US Treasury yields have already started to reflect this, with the 10-year hovering above 4.5% and threatening to push higher as supply-demand imbalances worsen.

Tariff Talks: Thanking the fire fighter for putting out the fire – when they started it!

Markets remain hopeful that the effects of the global wave of tariffs announced by the United States will be diluted through diplomacy. The only concrete agreement to emerge has been a limited trade deal with the UK, a country that, crucially, does not run a significant trade surplus with the US and was therefore never a priority target in this trade rebalancing agenda.

The latest news from the US–China negotiations is undeniably positive in tone, even if short on detail. Reports suggest Washington may reduce tariffs on Chinese goods to 30%, while Beijing is expected to lower its duties on U.S. imports to 10%. This marks a notable shift from the previously imposed tariffs of 45% on Chinese exports and 125% on American products. Markets are responding with cautious optimism, reflecting hopes that this could mark the start of a broader de-escalation in global trade tensions.

In the background, global shipping data continues to deteriorate. Container volumes through the Panama Canal and between China and the US West Coast have fallen sharply since March, confirming that trade is already being rerouted or curtailed in anticipation of tariffs. Reports late last week suggested that there are currently no shipping departures from China to ports on the West Coast of the United States.

Fed Remains Cautious, Watching Tariffs and Inflation Play Out

The Federal Reserve’s latest two-day meeting once again confirmed that the central bank remains cautious, reactive, and not inclined to pre-empt market hopes for rate cuts. While Chairman Powell acknowledged the recent cooling in some inflation indicators, he was equally clear that the Fed remains data-dependent and uncertain about the full economic impact of the new tariffs and fiscal policy shifts.

The Fed’s reluctance to act quickly was underscored by references to “elevated uncertainty.” Officials expressed concern about both upside inflation risks—especially in services—and downside growth risks, particularly if tariffs prove to be overwhelming in the second half of the year. The probability of a near-term rate cut has been dialled back accordingly, with September now the earliest credible window for any easing.

With the Fed positioning itself as a referee rather than a firefighter, the takeaway for investors is don’t expect a policy lifeline any time soon. Just this month alone, the market pricing of the number of 25-bp rate cuts by year end has moderated to around two rate cuts from three.

Chart 1: Market Pricing of the Scale of Fed Rate Cuts by Year-End Continues to Moderate (%) Source: Bloomberg

Source: Bloomberg

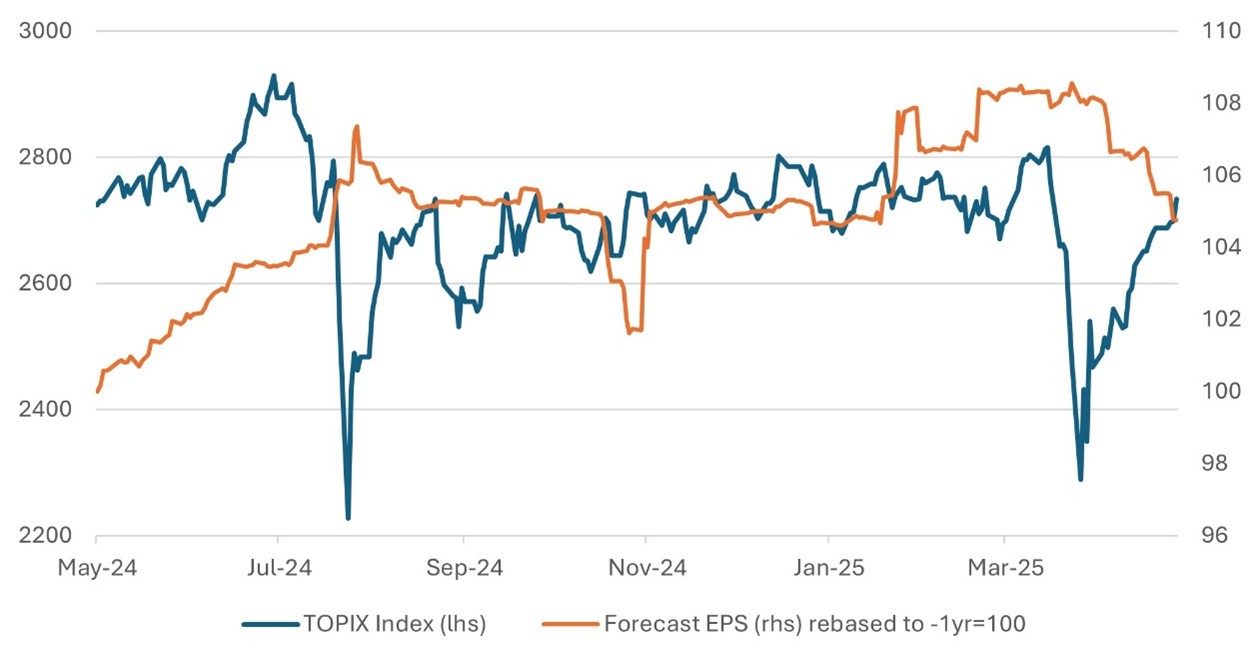

Japan’s Market Streak Reflects Long-Awaited Catch-Up

In a rare bright spot, Japanese equities notched an impressive 11-day winning streak—the longest since 2013. The Nikkei 225 has begun to recoup its earlier underperformance, as a softer yen, improved earnings revisions, and receding concerns over Bank of Japan (BoJ) tightening have proved handy. The BoJ remains cautious, gradually retreating from ultra-loose policy under Governor Ueda, who has avoided abrupt shifts in policy. While wage growth is picking up, deflationary risks persist amid slowing global demand and weak exports, reinforcing the need for a steady policy hand.

Corporate activity has further lifted sentiment, with a rise in share buybacks, dividend increases, and restructuring announcements. Giants like Toyota and SoftBank have signalled renewed confidence, while hopes that Japan could benefit from global trade realignments, especially as China faces ongoing Western pressure, are adding to the bullish narrative.

That said, recent market momentum has been dented by weaker earnings forecasts in part because of a roughly 10% appreciation in the yen. However, we believe that with the yen possibly peaking, Japan’s solid fundamentals could reassert themselves and reignite equity outperformance.

Chart 2: Japanese Equities Stall Amid Weak Earnings Momentum Source: Bloomberg

Source: Bloomberg

Are India-Pakistan Tensions a Reflection of the Times?

Thankfully, as we write, tensions between India and Pakistan appear to be easing. However, the brief but intense conflict underscored the complex web of geopolitical rivalries—India’s French-built jets facing off against Pakistani Chinese-designed fighters, with the US scrambling to impose some order as the conflict threatened to spiral out of control. One wonders: were such clashes inevitable, or is America's retreat from global leadership, under the banner of "Make America Great Again", creating a vacuum where only instability thrives?

Conclusion: Navigating Cross-Currents

This week’s developments underscore the multi-dimensional nature of current market risks:

• Macroeconomic headwinds in the US are being amplified by questionable fiscal policy and sticky wage inflation.

• Trade optimism persists more out of habit than hard evidence, with breakthroughs few and far between.

• The Fed is treading carefully, acknowledging uncertainty rather than rushing to offer policy support.

• Geopolitical instability is rising in a world no longer anchored by clear leadership or institutional coordination.

In the meantime, equity markets—particularly in Japan and parts of Asia—are showing resilience. Investors appear to be selectively rotating capital in anticipation of policy divergence and opportunities in regional markets. However, the risks of complacency are growing. As seen in past cycles, financial markets can often ignore the buildup of macro and geopolitical pressure, until they no longer can.

Gary Dugan - Investment Committee Member

Bill O'Neill - Non-Executive Director & Investor Committee Chairman

12th May 2025

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. The information contained within should not be a person's sole basis for making an investment decision. Please contact your financial professional at Falco Private Wealth before making an investment decision. Falco Private Wealth are Authorised and Regulated by the Financial Conduct Authority. Registered in England: 11073543 at Millhouse, 32-38 East Street, Rochford, Essex SS4 1DB