By Falco

08 Oct 2024

• Employment data in the US was stronger-than expected, the market moved quickly to take out the possibility of a 50-bp rate cut

• US presidential polls remain tight, limiting further equity market gains

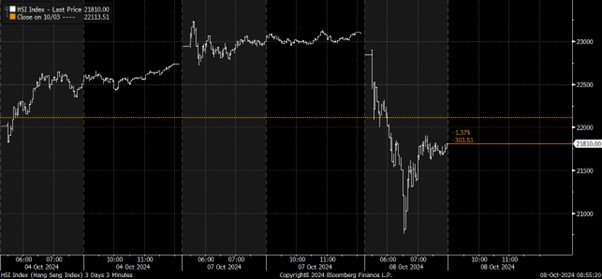

• The Hang Seng was down 9.4% today, reflecting the concerns that Chinese government measures announced are insufficient to sustain a rally.

It all looked too easy: a US soft landing, lower inflation, and a compliant-with-market-wishes Fed that was seemingly prepared to deliver to the market a further 50bps rate cuts. It was easy money for investors, and bonds and equities rallied.

A couple of US data points later, we still have good growth, but nascent inflation worries, and the Fed looks likely to downsize its forthcoming rate cut(s). Bonds sell-off, and interest rate sensitive stocks such as US REITS dip.

The US employment report was remarkably strong. The 254,000 new jobs added in the month of September were much higher than expected, and the unemployment rate fell to just 4.1%. Private sector jobs added were double the previous month's number. Long gone are the market's and probably the Fed's worries that the US labour market was showing any worrying signs of weakness. The great volatility in the employment report should, though, make us somewhat sceptical about taking the data too much on trust.

The Fed will likely have its head turned by the stronger-than-expected employment data; in any case, the market moved quickly to take out the possibility of a 50-bp rate cut at the Fed’s next meeting. The market now anticipates a 25-bp cut per meeting through the next 12 months. The data has becalmed the government bond market with a reset of higher yields across the curve back to where they were at the start of August and the US 2-year bond is roughly 40bps off its lows. Such a rise in yields looks like an uncharacteristic reaction, but it may also reflect the exaggerated trader positioning running into the day of the report.

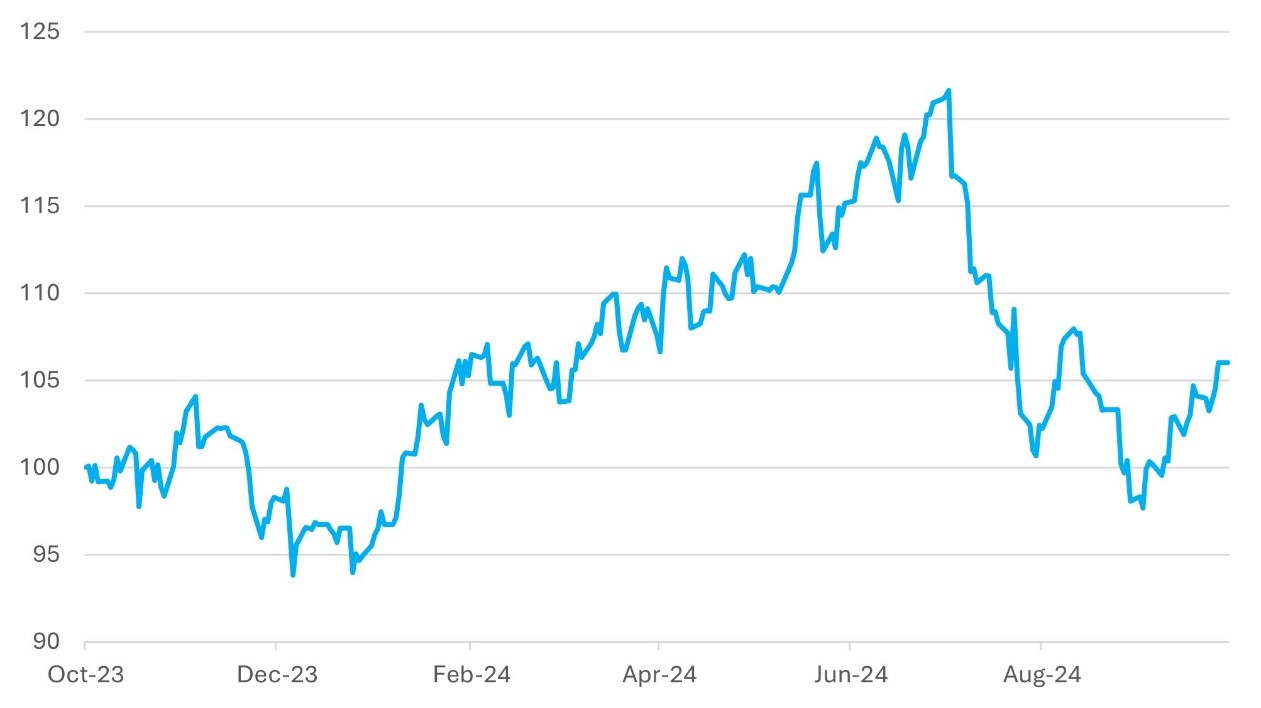

The employment report changed the leadership of the equity markets and, hence, may take some momentum away from the broader market. Utilities and REITs – the recent sector leaders – both ended Friday's trading session down on the day. The employment report's negative impact on the interest rate-sensitive stocks helped redirect investors back to the tech sector. Better-than-expected news from individual tech companies of late has already put the sector on a better footing. We think REIT stocks may struggle given the ongoing disappointing earnings growth.

With the market now expecting the Fed to cut rates by just 25bps per meeting, investors will have to be a great deal more patient in waiting for market returns.

Chart 1: US NASDAQ Index versus US REIT Index

Index

Source: Bloomberg

The pending US presidential election in just a few weeks is likely a countervailing risk event to limit further equity market gains despite the greater confidence about a soft-landing economic scenario. The polls remain so tight that no outcome is a foregone conclusion. Given the polarisation of political views, around half of the population will be hugely disappointed with the result. Post-election debate and challenges could go up to the electoral college vote, which is scheduled on 17th December.

At last week’s close, the S&P500 Index was technically at an extreme deviation from the medium-term averages, but it is getting there. Another 1-2 % rise in the index would be at the higher end of the range for deviation from the 50-day moving average. It is currently at a demanding P/E multiple of 24.7x when earnings forecasts for the current year continue to fall. However, in the tech sector, earnings forecasts continue to rise. Take a stock like NVIDIA ($124) for instance; while its share price is unchanged over a month, consensus earnings forecasts are up 6%.

Chart 2: US S&P500 Index Price Technical Indicate Need for a Pause

Source: Bloomberg

China struggling to Convince

As mainland Chinese markets re-opened, the nervousness in the market was palatable, with some immediate profit taking place on the Hong Kong exchange. The Hang Seng was down 9.4% on 8th October, which is some prudent profit-taking, or it may reflect the concerns among commentators that the Chinese government measures announced thus far are insufficient to sustain a rally in the market. Many economists talk of the need for at least two or three waves of further measures to effectively reduce the malaise in the economy. The loss of confidence among households is structural and will not disappear with some 'helicopter’ money. The National reform and Development committee disappointed the market with a lack of follow through measures in its missive released today. The committee talked about introducing new measures but no detail on scale or timing.

Investors may remain very tactical in their positioning. Foreign investors could cover any underweight in the market with the expectation that more measures must come from the government to give hope for better times in the economy. However, we wonder if too many investors believe we have seen sufficient structural changes to underpin better long-term prospects for the market. The complicating factor is the US elections, which could deliver a new Trump Presidency, a potential further headwind to any sustained rally in the Chinese equity market.

Chart 3: Hang Seng Index profit taking as investors wait for more from the Chinese government

Source: Bloomberg

Gary Dugan - Investment Committee Member

Bill O'Neill - Non-Executive Director & Investor Committee Chairman

8th October 2024

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. The information contained within should not be a person's sole basis for making an investment decision. Please contact your financial professional at Falco Private Wealth before making an investment decision. Falco Private Wealth are Authorised and Regulated by the Financial Conduct Authority. Registered in England: 11073543 at Millhouse, 32-38 East Street, Rochford, Essex SS4 1DB