By Falco

17 Jun 2024

• The Fed downgrades its expectations for rate cuts, however the market disagrees

• US interest rate sensitive stocks could rally after some painful underperformance

• French politics is all at sea, but the French equity market has probably fallen too far

The Fed doesn’t believe in significant early rate cuts – but the market could still be pricing that scenario

It has now become a game of conjecture about the US central bank’s next move on rates. The Fed recently shifting gears on its outlook on the number of rate cuts from three to just one over a span of three months has turned predicting its actions into a guessing game rather than an exercise in profound insight.

In any case, the FOMC left rates unchanged last week, which was expected, but there were notable changes in its outlook for rates. The updates to its statement didn't quite align with its earlier forecast on rate cuts. In May, the committee mentioned "a lack of progress" towards the inflation target, but it now states that there is "modest progress." This raises the question: why did it then reduce the anticipated number of rate cuts by year-end?

Additionally, the Fed increased its 2024 inflation forecast by 20 basis points (bps). Overall, the messaging appears inconsistent and perhaps lacks any clear insight into what will happen next.

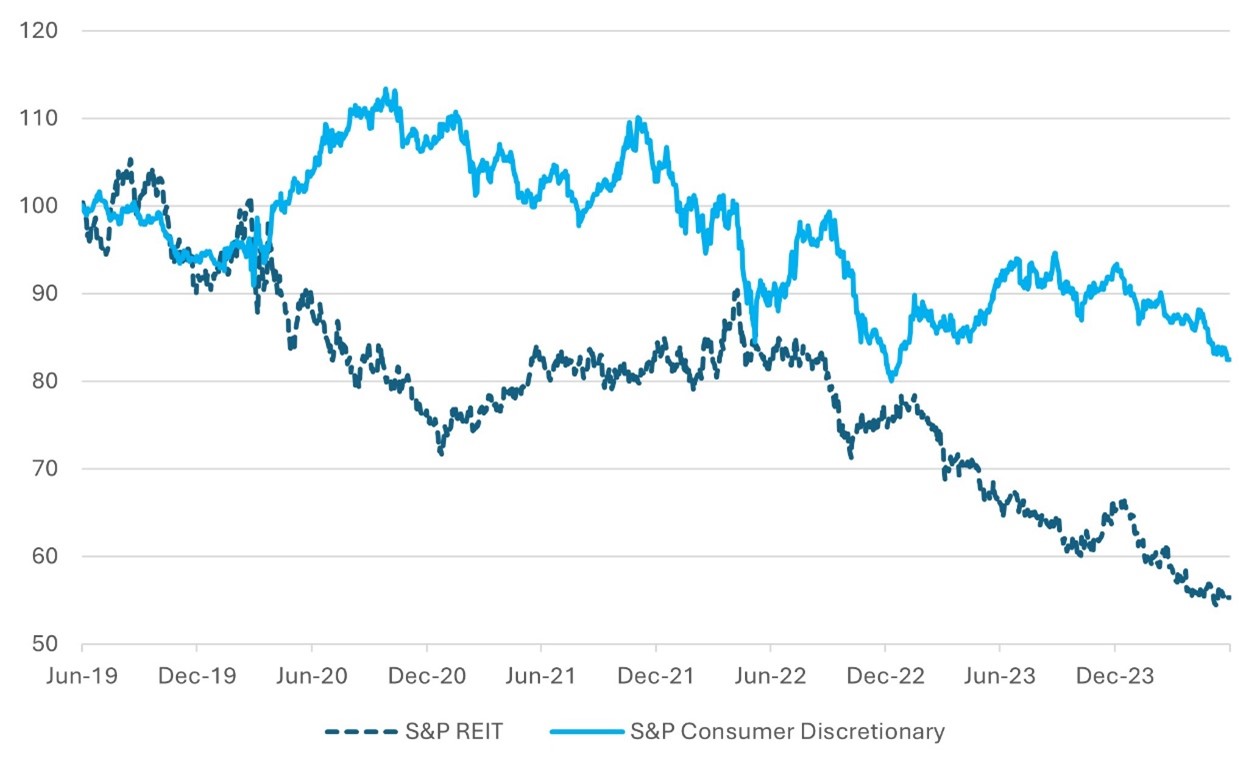

The Fed's inconsistent signalling is leading the market to increasingly make its own deductions about where the rates are headed. There is a growing market conviction that rates will come down quicker than the Fed currently forecasts. Consequently, there's been some talk of a potential rally in interest rate-sensitive sectors of the market. The obvious beneficiaries would be consumer discretionary stocks and REITs.

But, at the moment, that call could prove to be daunting. Investing in the REIT sector currently feels like catching a falling knife. Medium-term fundamentals remain challenging because of the crisis in commercial real estate and the unaffordable housing situation. However, any clear signalling by the Fed of lower rates could potentially push the sector 10% higher, driven by a relief rally.

Chart 1: Interest Rate Sectors on Their Back

Relative performance of US REITs and consumer discretionary stocks – rebased to June 2019=100

Source: Bloomberg

France Politically at Sea – But Maybe Discounted in the Market

The growing clamour for populism around the world, driven by voters reacting to the loss of spending power because of persistent inflation, continues to create turmoil. The most recent example is the Eurozone, with France currently at its epicenter and the UK following closely with a general election scheduled on 4th July.

A week after French President Macron’s decision to call elections, the French political scene remains turbulent, adding to investors’ risk aversion stance as far as European asset markets are concerned. The French political establishment’s efforts to counter the rise of the extreme right have been chaotic. A coalition of left-wing parties, the New Popular Front (NPF), was formed this past week but has already encountered problems putting together its list of candidates for the first round of elections on 30th June. On the other hand, the coalition of center-right parties is facing infighting and performing poorly in the polls. Its leader, Eric Ciotti, made alliances with some right-wing parties, leading to his expulsion from the party, which was subsequently blocked by the courts.

Opinion polls are struggling to keep up with the machinations of newly formed alliances and fallouts. However, it is clear that Macron's party is in trouble. Current polls suggest that the far-right party, RN, could secure the largest number of seats, estimated at around 220-270. The left is projected to win 150-190 seats. Macron’s alliance is expected to come third with 90-130 seats, and the center-right is currently polling at a level that would give it 30-40 seats. The French Assembly has 589 seats, implying that the RN could potentially be the top contender for the prime minister’s post but it would of course need to collaborate with another group to achieve an absolute majority.

The events of the past few weeks in Europe have laid bare the financial edge that many nations currently live on. France has structural problems, including excessive debt and insufficient fiscal discipline. According to the National Institute of Statistics and Economic Studies, the French statistics institute, the country ran a public deficit of 5.5% of GDP in 2023, up from 4.8% in 2022. French public debt is at an unsustainable 110.6% of GDP. The government and market were hoping for better news through economic growth, increased tax revenues, and improved government efforts to contain spending. However, Marine Le Pen, the leader of the RN party, proposed measures in her 2022 presidential platform that could potentially cost €100 billion.

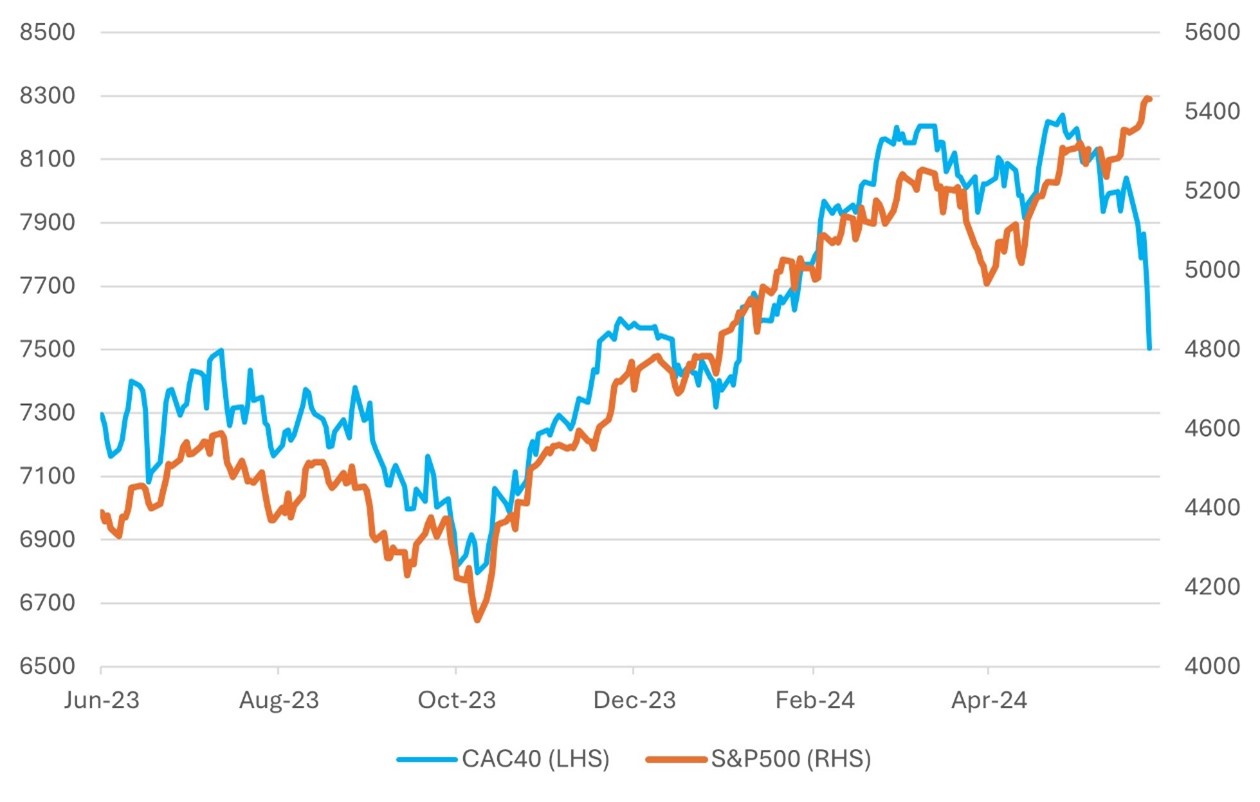

Given the current situation, it might be time to cautiously re-enter the French equity market. Despite the political challenges, the sharp drop in the equity market may have overly discounted the risks. This is not the first time that France has faced messy politics, with the so-called cohabitation between a president of one political persuasion and a ruling party of another. Compromises will be essential. Many French stocks are down 15% in the past two weeks. The median stock in the CAC40, such as Veolia, offers a dividend yield of 4.5%, which is 140 bps more than French government 10-year debt.

Chart 2: France’s Remarkably Poor Equity Market Performance Versus US Equities

Source: Bloomberg

Gary Dugan - Investment Committee Member

Bill O'Neill - Non-Executive Director & Investor Committee Chairman

17th June 2024

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. The information contained within should not be a person's sole basis for making an investment decision. Please contact your financial professional at Falco Private Wealth before making an investment decision. Falco Private Wealth are Authorised and Regulated by the Financial Conduct Authority. Registered in England: 11073543 at Millhouse, 32-38 East Street, Rochford, Essex SS4 1DB