By Falco

18 Nov 2024

• After initial euphoria, markets react to the disruptive nature of the transition to a new presidency

• Q4 US growth may gain momentum from animal spirits

• Market can sense the Fed's concern about sticky US inflation

• Equities may be set for further gains after recent consolidation

• European markets are at sea as German government collapses - but will the ECB ride to the rescue?

• Japan settles after elections - tactically there may be upside in the equity market

• Bitcoin keeps going

The US presidential elections have long been recognised as a pivotal event for financial markets, given the profound implications for fiscal, monetary, and regulatory policies both for the US and the world. With a new president all set to take over in weeks, the financial markets appear to be navigating a fine line between short-term optimism over pro-growth policies and apprehensions about their long-term sustainability and potential execution challenges.

The election of Donald Trump has undoubtedly stirred strong reactions. His campaign's focus on tax cuts, deregulation, and infrastructure spending initially buoyed market sentiment. However, the potential costs of these policies—boosting deficits and inflationary pressures, for example—introduce significant uncertainties. Furthermore, doubts persist about the incoming administration's ability to implement its agenda effectively amid sharp political polarisation.

Initial Market Reactions

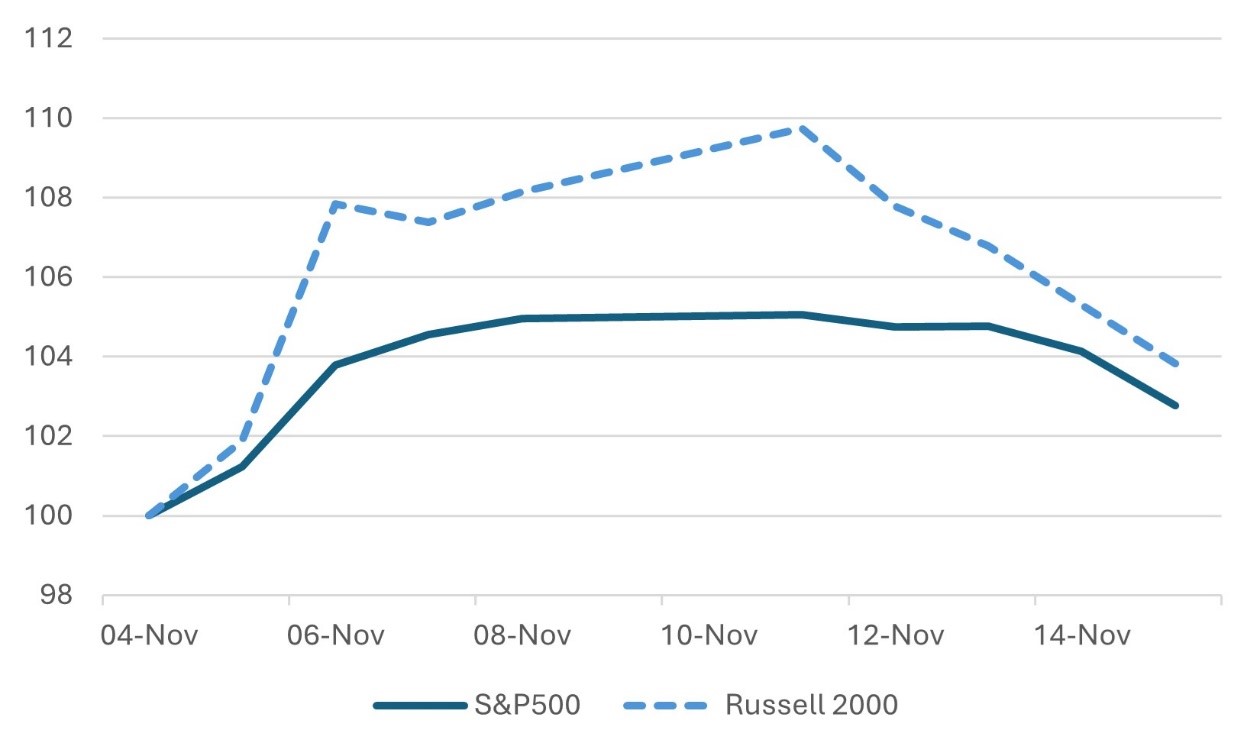

The equity markets’ initial reaction to Trump’s election was overwhelmingly positive. The S&P 500 surged more than 4% post-election, while the Russell 2000 small-cap index posted an extraordinary gain of nearly 10%, reflecting investors’ optimism about domestic growth prospects. However, by the end of the first week, some of that exuberance had begun to fade. Equity valuations, particularly in interest rate-sensitive sectors, faced headwinds as long-term bond yields rose. The US 10-year Treasury yield climbed 37 basis points at its peak, reflecting expectations of higher inflation and increased government borrowing going forward.

Chart 1: Equity Market Rally Fades

Index Source: Bloomberg

Source: Bloomberg

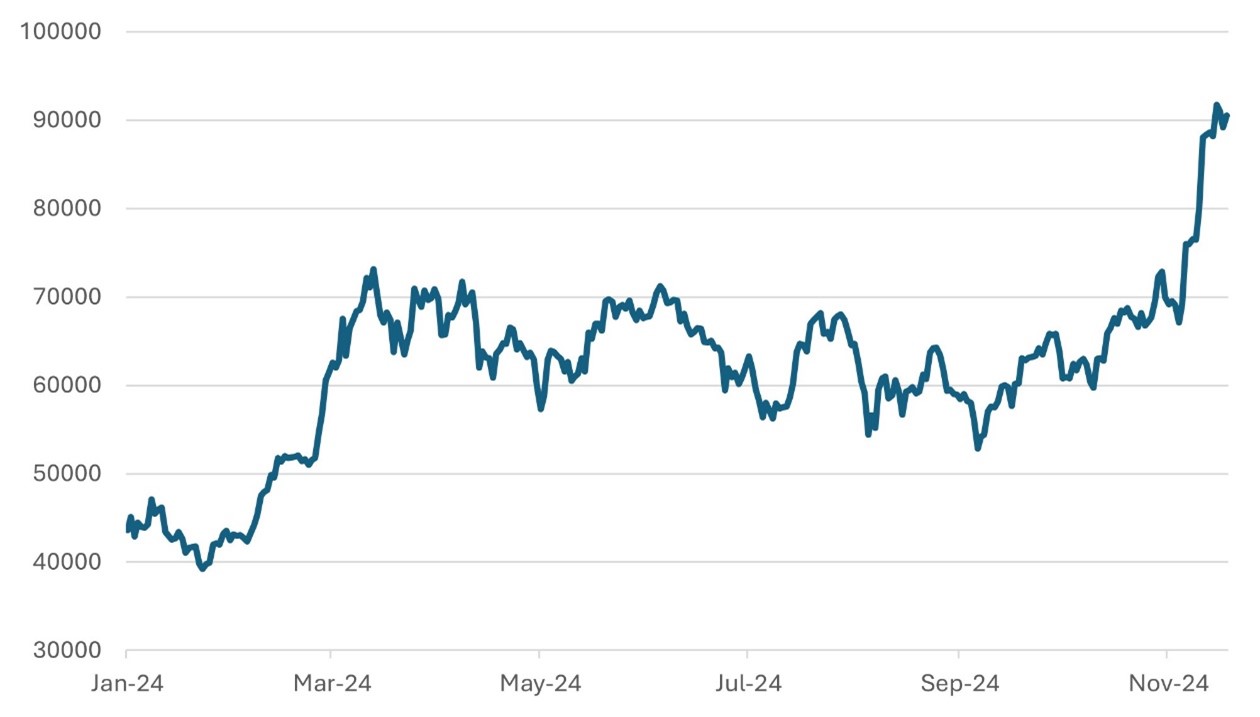

Notably, the US dollar strengthened, with the trade-weighted dollar index up 3.2%, as markets priced in a tighter monetary policy in response to the anticipated fiscal stimulus. Bitcoin, often considered a hedge against macroeconomic instability, emerged as a standout winner, with a 30.6% return since November 5. This rally can be attributed to two key factors: growing interest of investors seeking diversification towards digital assets and a perception that the incoming administration might adopt a more favourable stance on cryptocurrencies.

Table 1: Financial Market Movements Since Election Day

| Change to Peak | Change to last Friday close | |

| S&P500 | +4.4% | +2.0% |

| Russell 2000 | +9.4% | +3.2% |

| MSCI World ex US (US$) | +0.7% | +0.4% |

| US 10-year Yield | +37bps | +28bps |

| Dollar Trade-Weighted | +3.2% | +3.2% |

| Bitcoin | +32.6% | +30.6% |

Source: Bloomberg

Medium-Term Considerations

Although the announcement of the results was met with initial euphoria that saw equities rally, financial markets will likely focus on several key drivers to get a better sense of the Trump administration’s priorities:

1. Policy Implementation and Clarity:

Markets are eagerly awaiting finer details to emerge on the administration’s fiscal plans, especially the scale and timing of the proposed tax reforms and infrastructure spending. Any delay or dilution of these proposals could temper optimism.

2. Inflation and Interest Rates:

The Federal Reserve faces a delicate balancing act. A surge in consumer confidence, potentially boosting holiday spending, might accelerate inflationary pressures, forcing the Fed to maintain the status quo or even tighten monetary policy. Current money market pricing suggests a 50-50 probability of a rate cut by year-end, but the likelihood of such a move diminishes with stronger economic data. Should the Fed hold off on easing, equity markets could face increased volatility, particularly in growth-sensitive sectors.

3. Global Market Dynamics:

The disparity between US and global equity market performance is striking. The MSCI World ex-US index showed muted gains compared with the US markets, reflecting ongoing concerns about slower global growth and geopolitical risks. A stronger dollar may further challenge emerging markets and US exports, potentially leading to uneven economic impacts.

4. Bitcoin and Alternative Assets:

Bitcoin's remarkable post-election performance highlights the growing interest in alternative assets amid heightened policy uncertainty. While speculative factors may partially explain the rally, the broader trend of digital asset adoption suggests evolving portfolio diversification strategies.

Chart 2: Bitcoin the Clear Winner (BTC to USD) Source: Bloomberg

Source: Bloomberg

Looking Ahead

Market sentiment in the weeks ahead will hinge on post-election surveys of business and consumer confidence. An upswing in confidence, coupled with robust holiday spending, could bolster GDP growth in the final quarter of the year. However, such a scenario could also stoke inflation fears, putting further upward pressure on bond yields. In turn, higher yields could dampen equity valuations, particularly in high-growth, high-multiple sectors.

The interplay between fiscal stimulus expectations and monetary policy will remain a central theme. Investors will need to monitor not only the trajectory of US economic indicators but also the global implications of a stronger dollar and rising US interest rates. As markets digest these dynamics, volatility may persist, requiring careful portfolio positioning and a readiness to adapt to policy and macroeconomic developments.

Global Reactions to the US Election: A Shift in Focus

The US elections have triggered a flurry of activity across the globe as nations engage in strategic repositioning in anticipation of the Trump administration's policy priorities. While much of the news out of Washington has centred on personnel announcements—such as cabinet appointees focused on domestic issues like healthcare, immigration, and government efficiency (notably Elon Musk’s involvement). However, there has been little concrete information regarding tariffs or broader trade policy, leaving room for speculation and strategic recalibration internationally.

China: A Cautious Engagement

China's approach to the US election outcome has been measured yet strategic. President Xi Jinping’s pledge to collaborate with President-elect Donald Trump during his meeting with outgoing US President Joe Biden on the sidelines of the Asia-Pacific Economic Cooperation summit signals Beijing’s intent to tread carefully on bilateral relations. This proactive diplomatic move underscores China’s recognition of the potential volatility in US-China relations under the new administration.

For now, China appears focused on mitigating risks to its economic trajectory, particularly in light of uncertainties surrounding potential US tariffs and trade policy shifts. Markets will likely watch closely for signs of whether China pursues stimulus measures or reforms to brace for a more protectionist US stance.

Europe: A Region in Flux

The election of Donald Trump has acted as a wake-up call for European policymakers, compelling them to chart their economic and political futures with greater conviction. There are murmurs among economists that the European Central Bank (ECB) could respond to Europe’s sluggish growth with an aggressive 50 basis-point interest rate cut in its next meeting. While such a move could provide short-term relief to bond markets, it remains to be seen how Europe’s deeper structural issues are addressed.

The region continues to grapple with economic stagnation and political instability. Germany’s government coalition collapse earlier this month, followed by the prospect of new elections, adds to the uncertainty. Rather than sparking innovative growth strategies, the prevailing discourse remains fixated on fiscal discipline, with little appetite for bold, alternative economic policies.

There is hope that the ECB might step up with an accelerated programme of monetary easing to stave off further economic malaise. However, without coordinated fiscal stimulus or structural reforms, Europe risks falling further behind its global counterparts.

Japan: A Glimmer of Stability

Amid the global uncertainty, Japan stands out as a relative beacon of stability. The re-election of Prime Minister Shigeru Ishiba signals continuity and an intent to pursue expansionary fiscal policies. Ishiba’s proposed budget emphasises support for low-income workers, reflecting a commitment to addressing income inequality while stimulating domestic demand.

Meanwhile, the Bank of Japan (BOJ) remains steadfast in its accommodative monetary stance. The prospect of a forthcoming rate increase by the BOJ could provide support to the yen, bolstering investor confidence in the Japanese equity market. With stocks rebounding from recent lows, there is cautious optimism that Japan’s markets could deliver strong returns in the near term.

Chart 3: Nikkei May Have Upside after Domestic Elections Source: Bloomberg

Source: Bloomberg

Conclusion: A Global Rebalancing

The global response to the US elections underscores the interconnectedness of financial markets and economic policy. While some regions, like Japan, appear poised to leverage stability and proactive measures, others, particularly Europe, remain mired in uncertainty. China’s diplomatic overtures signal a strategic recalibration, reflecting the importance of its economic relationship with the US.

As the new US administration takes shape, its policies will likely serve as a catalyst for shifts in global economic strategies. The coming months will reveal whether other nations can navigate the challenges and opportunities posed by a shifting geopolitical and economic landscape.

Gary Dugan - Investment Committee Member

Bill O'Neill - Non-Executive Director & Investor Committee Chairman

18th November 2024

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. The information contained within should not be a person's sole basis for making an investment decision. Please contact your financial professional at Falco Private Wealth before making an investment decision. Falco Private Wealth are Authorised and Regulated by the Financial Conduct Authority. Registered in England: 11073543 at Millhouse, 32-38 East Street, Rochford, Essex SS4 1DB