By Falco

24 Jun 2024

• The Third Plenum of the 20th Communist Party of China Central Committee should deliver news of structural change.

• After the recent pause in Chinese equity market performance, we see upside and downside risks for the market.

• A rally may depend on the engagement with a domestic investor who historically has not favoured equities.

There is a sense of investor anticipation/apprehension ahead of the third plenum of the 20th Communist Party of China Central Committee to be held in Beijing in July. It is important to not underestimate the importance of the occasion. A third plenary session of the central committee customarily unveils China's major medium- and long-term economic policies. Irrespective of whether one is positive or negative about the market, the event itself could mark a significant risk.

There is room for substantial equity market movement to the upside or downside. What will define the market’s direction is just how convincing the policies are perceived by investors as addressing the structural slowdown in growth and the challenges in the real estate sector.

The previous third plenums have seen some major policy shifts. The Third Plenum of the 11th Central Committee in 1978 brought in policy changes that paved the way for decades of rapid economic growth and opened the door to the outside world.

Xi Jinping has used previous National Congress meetings to consolidate his political power, most famously by having Hu Jintao, the former General Secretary of the Chinese Communist Party, escorted out of the hall at the closing ceremony of the 20th National Congress of the Chinese Communist Party in October 2022. Now Xi Jinping with his political control in place there is an expectation among commentators that he will use the third plenum to announce a broad range of initiatives.

Back in March, President Xi Jinping made the following comments, setting the scene for the upcoming meetings.

"I have repeatedly emphasized that reform and opening up are crucial tools for contemporary China to catch up with the times. China's reform will not pause, and its opening-up will not cease," ……."We are planning and implementing a series of significant measures to comprehensively deepen reform."

The last few months have seen the Chinese equity market rally, pause, and consolidate. We have seen some good gains from the lows; however, the market lost momentum when the economic data showed weakness towards the end of the first quarter. More recently, the economy has improved again but it's certainly not shooting the lights out.

The third plenum is expected to be a significant event for setting the country's economic and political agenda for the next several years. Historically, the third plenum has been crucial for launching major policy reforms, and this one will likely be no exception.

Key areas of focus for this plenum include:

1. Economic Reforms: With the Chinese economy currently experiencing a structural slowdown, there is a strong expectation for reforms aimed at boosting growth. This includes measures to stimulate domestic consumption, encourage private sector investment, and address the challenges in the real estate sector, which has been facing significant headwinds because of high debt levels and weak sales.

2. Technological Innovation: The plenum is likely to emphasize the importance of technological innovation as a driver of economic growth. This aligns with the president’s vision of making China a global leader in high-tech industries. Reforms in the science and technology sectors, particularly in the semiconductor industry, are anticipated to support this goal.

3. Foreign Investment: Efforts to improve the business environment and attract foreign investment will be prioritized. This includes enhancing intellectual property protections and making cross-border data flows smoother, which are crucial for creating a favourable investment climate.

4. Social Reforms: Reforms in areas such as the pension system and the household registration (hukou) system are expected to be on the agenda. These reforms aim to address the challenges posed by China's rapidly aging population and to ensure more equitable access to social services for rural migrants in urban areas.

5. Political and Security Issues: While the primary focus is on economic reforms, the plenum may also address key political and security issues, including the party's stance on geopolitical tensions and internal security measures.

Overall, the third plenum is anticipated to unveil comprehensive strategies to address both immediate economic challenges and long-term developmental goals, balancing growth with stability and security considerations.

For the equity market’s sake, this is an opportunity we hope the authorities will lap up with both hands – the opportunity to re-position the China story as ‘back on track’. Some matters are clearly more beyond their control, in particular the trade embargoes and increased tariffs on tech and EV sectors. However, at this stage, investors are looking largely towards the domestic policies for the good news.

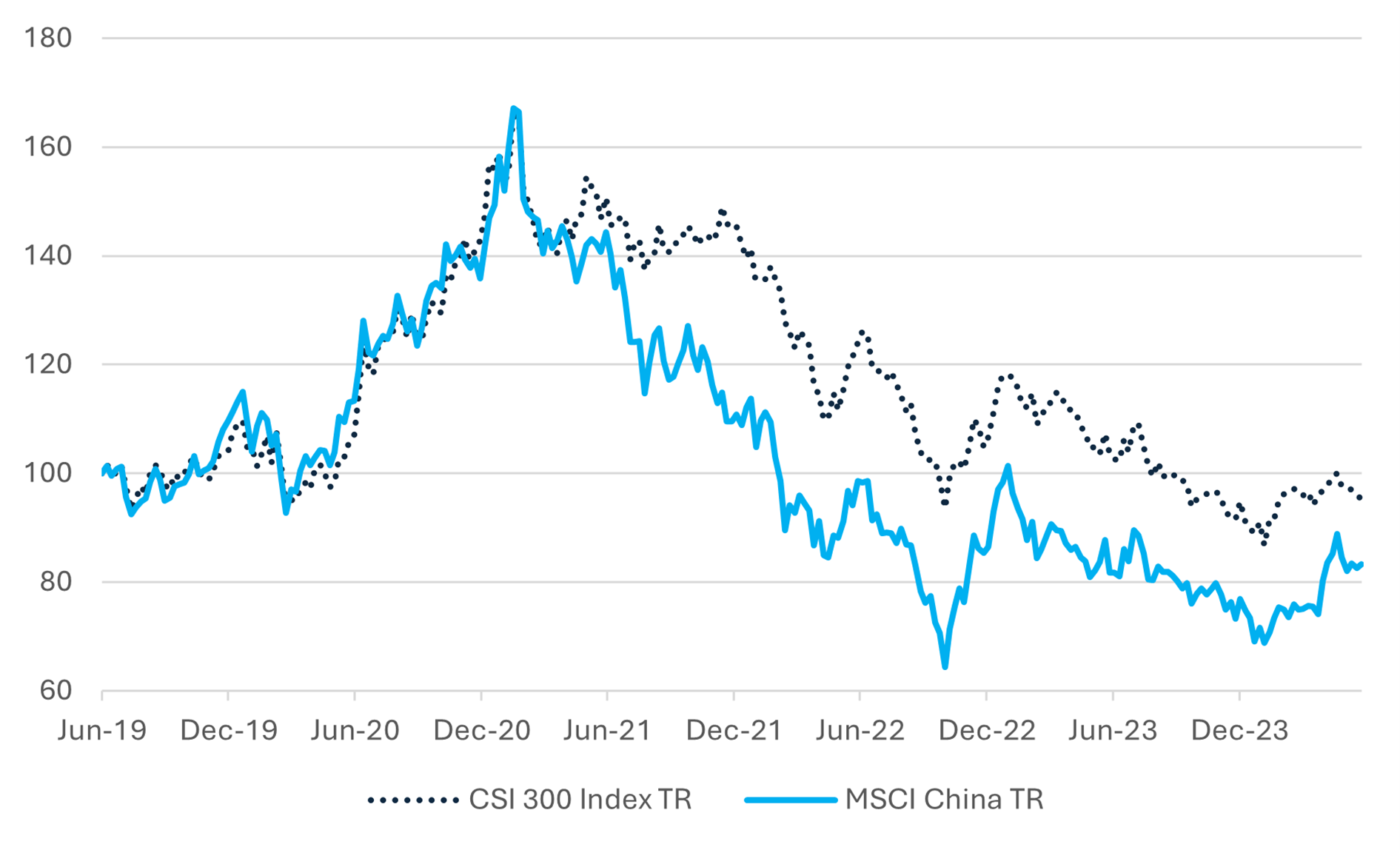

Chart 1: China’s Equity Indices Nursing no Better Than Break-Even Over Five Years

Indices rebased to June 2019=100

Source: Bloomberg

Structural Problems Aside, China Story is Gaining Traction

Despite China’s problems, it remains around 20-25% of global emerging market indices, an allocation that can’t be ignored. Some time ago, institutional investors questioned whether they needed to adjust the emerging market (EM) indices they follow to an EM ex-China index because of the debate about whether China was investable. Just as that idea was gaining traction, Chinese equities witnessed heavy buying by foreign investors from the February lows through to the end of April. This market rally was also supported by concerted government buying through the Chinese state fund, Central Huijin. The fund invested $41 billion into the equity market via ETFs in the first quarter. As a result, the indices rallied nearly 30% from their end-of-January lows to mid-May. However, we doubt there will be any such intervention on this occasion; rather, domestic policymakers will likely hope that their policies alone will provide the shock and awe needed to attract both domestic and foreign investors.

While there is a lot of focus on international flows into the Chinese equity market, the greater opportunity over the medium term is for more substantial allocations of domestic wealth in the market. Domestic investors have around $20 trillion in bank savings accounts and just $0.8 trillion in the equity market. About 52% of household gross assets are in real estate. Clearly, the household speculation in real estate has been unexpected and the president has made it his mission to put an end to this.

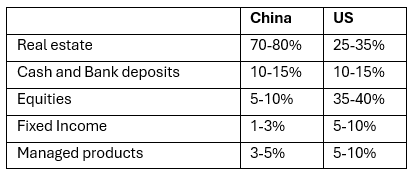

To put things into context, let’s take a look at the holding pattern of household wealth in China versus the US.

Table 1: Chinese versus US household wealth allocations across assets and products

Sources:

- Asia House: "China's Third Plenum: Key reforms likely to usher in a new economic era"

- Wilson Center: "China's Third Plenum: What You Need to Know"

- South China Morning Post: "China’s Communist Party to hold long-delayed third plenum, a key meeting for economic strategy"

- Nikkei Asia: (April 2024) China to hold key Communist Party plenum in July amid economic pressure

Gary Dugan - Investment Committee Member

Bill O'Neill - Non-Executive Director & Investor Committee Chairman

24th June 2024

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. The information contained within should not be a person's sole basis for making an investment decision. Please contact your financial professional at Falco Private Wealth before making an investment decision. Falco Private Wealth are Authorised and Regulated by the Financial Conduct Authority. Registered in England: 11073543 at Millhouse, 32-38 East Street, Rochford, Essex SS4 1DB